This message was edited on

May 30, 2012 at

11:54:19 AM by hosehead

Reply to:

Posted By: TMac #24 on May 30 2012 at 06:04:07 AM

Last night I was reading someone elses thread about a investment scandel or something like that involving Chris Luck. I had to leave the house for my sons ball game and now I cant find that thread to continue reading. Is the #19 team in trouble or going to be?

|

Adrian J Cotterill, Editor-in-Chief

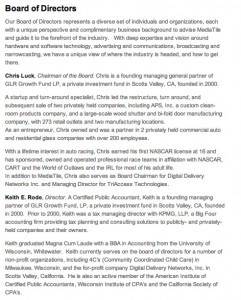

Two members of MediaTile’s board of directors,

including their Chairman, might well have a few more important things

on their mind at the moment than the actual welfare of MediaTile.

Chris

Luck, founding managing general partner of GLR Growth Fund LP, a

private investment fund in Scotts Valley, CA who is MediaTile chairman

and Keith E. Rode a Director (and also listed as a founding managing

partner of GLR Growth Fund) will no doubt be slightly troubled by the

reports ‘Scotts Valley Money Manager Charged in $60 Million Ponzi Scheme‘ which emerged in several local California papers late last week. Chris

Luck, founding managing general partner of GLR Growth Fund LP, a

private investment fund in Scotts Valley, CA who is MediaTile chairman

and Keith E. Rode a Director (and also listed as a founding managing

partner of GLR Growth Fund) will no doubt be slightly troubled by the

reports ‘Scotts Valley Money Manager Charged in $60 Million Ponzi Scheme‘ which emerged in several local California papers late last week.

According to the SEC, a certain John A. Geringer, who papers say “managed the Scotts Valley-based GLR Growth Fund”, used “false and misleading marketing materials to lure investors into believing that the fund was earning double-digits annually.”

In reality, Geringer’s trading generated ‘consistent losses’ and he eventually stopped trading all together, the SEC said.

MediaTile are listed as part of the GLR GROWTH FUND Investment Portfolio and secured a growth equity round of funding from them back in November 2009.

Interestingly the SEC has said that by mid-2009, the fund did not

invest in publicly-traded securities at all. The fund instead invested

heavily in illiquid investments in two private startup technology

companies. The rest of the money was allegedly paid to investors in

Ponzi-like fashion with money from newer investors.

It is not clear whether one of those two private startup technology

companies was MediaTile but the dates of mid-2009 and November 2009

would lead many to jump to that conclusion.

Just what Palmarés Advisors, who have been shopping MediaTile around for some months now, make of all this is as yet unclear.

Note that GLR stands for Geringer, Luck, Rode so it is not like Mr Geringer is some junior partner.

|

This message was edited on

May 30, 2012 at

11:55:41 AM by hosehead

Reply to:

Posted By: TMac #24 on May 30 2012 at 06:04:07 AM

Last night I was reading someone elses thread about a investment scandel or something like that involving Chris Luck. I had to leave the house for my sons ball game and now I cant find that thread to continue reading. Is the #19 team in trouble or going to be?

|

U.S. Securities and Exchange Commission

LITIGATION RELEASE NO. 22375 / May 24, 2012

Securities and Exchange Commission v. GLR Capital Management,

LLC, GLR Advisors, LLC, Geringer, Luck & Rode LLC, John A.

Geringer, and Relief Defendant GLR Growth Fund, L.P., Civil Action No. 12-02663 (U.S. District Court for the Northern District of California, filed May 24, 2012)

SEC CHARGES NORTHERN CALIFORNIA FUND MANAGER IN $60 MILLION SCHEME

On May 24, 2012, the Securities and Exchange Commission charged an

investment adviser in Scotts Valley, Calif., with running a $60 million

investment fund like a Ponzi scheme and defrauding investors by touting

imaginary trading profits instead of reporting the actual trading losses

he had incurred.

The SEC alleges that John A. Geringer, who managed the GLR Growth

Fund (Fund), used false and misleading marketing materials to lure

investors into believing that the Fund was earning double-digit annual

returns by investing 75% of its assets in investments tied to well-known

stock indices like the S&P 500, NASDAQ, and Dow Jones. In reality,

Geringer’s trading generated consistent losses and he eventually

stopped trading entirely. To mask his fraud, Geringer paid millions of

dollars in “returns” to investors largely by using money received from

newer investors. He also sent investors periodic account statements

showing fictitious growth in their investments.

According to the SEC’s complaint filed in federal court in San Jose,

Geringer raised more than $60 million since 2005, mostly from investors

in the Santa Cruz area. Geringer used fraudulent marketing materials

claiming that the Fund had between 17 and 25 percent annual returns in

every year of the Fund’s operation through investments tied to major

stock indices. Although the Fund was started in 2003, marketing

materials claimed 25 percent returns in 2001 and 2002 – before the Fund

even existed. The marketing materials also falsely indicated a nearly

24 percent return in 2008 from investing mainly in publicly traded

securities, options, and commodities, while the S&P 500 Index lost

38.5 percent.

The SEC alleges that Geringer’s actual securities trading was

unsuccessful, and by mid-2009 the Fund did not invest in publicly traded

securities at all. Instead, the Fund invested heavily in illiquid

investments in two private startup technology companies. The rest of

the money was paid to investors in Ponzi-like fashion and to three

entities Geringer controlled that also are charged in the SEC’s

complaint.

According to the SEC’s complaint, Geringer further lied to investors

on account statements that falsely claimed “MEMBER NASD AND SEC

APPROVED.” The SEC does not “approve” funds or investments in funds,

nor was the Fund (or any related entity) a member of the NASD (now

called the Financial Industry Regulatory Authority – FINRA). Geringer

also falsely claimed that the Fund’s financial statements were audited

annually by an independent accountant. No such audits were performed.

The SEC’s complaint alleges Geringer and three related entities

violated or aided and abetted violations of Section 17(a) of the

Securities Act of 1933, Section 10(b) of the Securities Exchange Act of

1934 (Exchange Act) and Rule 10b-5 thereunder, and Section 206(1), (2),

and (4) of the Investment Advisers Act of 1940 and Rule 206(4)-8

thereunder. The complaint also alleges the defendants violated or aided

and abetted violations of Section 26 of the Exchange Act, which bars

persons from claiming the SEC has passed on the merits of a particular

investment. The SEC’s complaint names the Fund as a relief defendant.

The complaint seeks preliminary and permanent injunctions, disgorgement

of ill-gotten gains, civil monetary penalties, and other relief.

Geringer, the Fund, and two of the GLR entities consented to the entry

of a preliminary injunction and a freeze on the Fund’s bank account.

The SEC’s investigation, which is continuing, has been conducted by

Robert J. Durham and Robert S. Leach of the San Francisco Regional

Office. The SEC’s litigation will be led by Sheila O’Callaghan of the

San Francisco Regional Office.

The SEC thanks the U.S. Attorney’s Office for the Northern District

of California, Federal Bureau of Investigation, and FINRA for their

assistance in this matter.

http://www.sec.gov/litigation/litreleases/2012/lr22375.htm

|